Economics

Economy may be daunting to some, but the questions are based on your conceptual understanding of macroeconomics. No matter how many times you read and mug-up the data, you are bound to falter in the exam. Conceptual clarity is what matters the most in Economics . On an average around 14-15% weightage is given to Economics. If your basic fundamentals of Economics are clear, then you will even be able to get all answers right in Prelims . So our sincere advice to you is to invest more time in understanding the concepts and analyzing how one concept is linked to another.

Once you get hold of this subject, it will take very less time to revise and also more accuracy can be achieved in the exam.

HERE, WE HAVE DIVIDED THE UPSC SYLLABUS INTO ITS CONSTITUENTS, ALONG WITH THE AREAS THAT NEED MORE FOCUS OR TIME, BASED ON PAST YEARS’ PATTERN:

Basic Economic and Indian Economy:

1. Introduction to Economics:

Focus:

Understanding the basic concepts of:

- Macroeconomics – Poverty, Growth, Employment etc.

- Microeconomics – decisions/choices made at a company, household or an individual level

- Difference between Growth and Development; indicators used to measure.

- National Income Accounting – Gross National Product (GNP), Gross Domestic Product (GDP), Gross National Income (GNI), Factor cost, Market Price, Purchasing power parity(PPP), Per-Capita Income (PCI) – a general understanding on how they are calculated and what all factors go into their calculation

- Primary, Secondary, Tertiary Sectors – what constitutes each sector? What are their contributions to the GDP

- Capitalist, State, Mixed Economic System – which type of Economic system India has adopted and why?

Note: Don’t just read definitions, analyze! For example: When do we use GDP for measurement of Growth and not GNP? Which method is followed in India and why? When we say ‘why’ a particular method was adopted- it means that, one has to understand both positives and negatives of the method.

2. Growth & Development

Focus:

- Poverty– concepts like Below Poverty line (BPL), Poverty Gap, Poverty estimates by National Sample Survey Organisation (NSSO), which Institution in India decides on Poverty line- Planning Commission

- Different Committees set-up to measure poverty, methodology used – Alag committee, Lakadwala, Suresh Tendulkar Committee, NC Saxena Committee, Rangarajan Committee – A general understanding of how each committee differed in their measurement.

- Inequality – how is it measured –Gini co-efficient, Lorenz Curve; concepts like relative inequality, absolute inequality.

- Issues with employment , different types of unemployment like disguised unemployment, underemployment etc; Globalization and its impact on labour.

- Demographic Dividend, Skill Development

- Development Indicators from International organisations like HDI, MPI (Multiple Poverty Index), Millennium Development Goals etc.

Note: Make a note of the Government Schemes, Committees related to growth, development, eradication of Poverty, Employment, Labour issues etc. like MGNREGA, National Rural Livelihood Mission, Bharat Nirman etc. Initiatives like ‘Make in India’, Innovation Council, Skill Development Initiative Scheme (SDIS).

3. Inflation and Business Cycle

Focus:

- Inflation, Depression, Recession and related terms and concepts like deflation, disinflation, reflation, stagflation, Philip’s curve

- Types of Inflation – based on the rate of growth of the prices– creeping, trotting, galloping, hyper-inflation

- Types of Inflation – based on the causes– Demand-pull, Cost-push, Structural, Speculation.

- Impactof Inflation on Indian Economy, different stakeholders in the economy. Is a minimum inflation necessary? If so why?

- Inflation measurements like CPI, WPI, GDP deflator

- Composition or what constitutes these indicators

- Their merits and demerits

- Which measurement is better indicator of inflation and why? Which index is used to measure inflation in India currently?

- Base year from which it’s calculated.

- What is this Base year?

- Why does Government change the Base Year?

- What impact it has on the economic growth or inflation?

- Role of Government and RBI in controlling inflation

4. Money and Banking Systems

Focus:

- Role and functions of RBI

- Monetary Policy/measures taken by RBI like Bank rate, repo rate, reverse repo rate, Statutory Liquidity Ratio (SLR), Cash reserve Ratio (CRR), Liquidity Adjustment Facility (LAF), Marginal Standing Facility (MSF)

- Why are these measures taken?

- What impact it has on the Supply of money, Inflation and the Economy?

- Different types of Banks and their functioning – Commercial Banks, RRB’s, Development banks, NABARD, Co-operative Banks, Development Banks, Merchant Banks, Non-Banking Financial Company’s (NBFC’s), Regional Rural Banks (RRBs) etc.

- Functions of these Banks, to whom do they lend?

- How are these Banks regulated? Concepts like priority sector lending

- Banking reforms like Bank Nationalisation (1969, 1980) Basel Norms etc.

- Why were/are these reforms needed?

- What was/is the Purpose of these reforms

- Understand Key-Terms – Financial Inclusion, Fiscal Consolidation, Narrow Banking, Non-Performing Assets, Shadow Banks, Weak Bank, Core Banking, Bank Run, Priority Sector lending, Capital to Risk Weighted Assets (CRAR) etc., and other related concepts related to Banking – what steps have been taken by the Government and RBI in this regard.

- Steps taken by government, with regard to Financial Inclusion.

- Recent Committee’s setup with regard to Banking Reforms and its important recommendations

Note: Make a note of the Government Schemes, Committees related to growth, development, eradication of Poverty, Employment, Labour issues etc. like MGNREGA, National Rural Livelihood Mission, Bharat Nirman etc. Initiatives like ‘Make in India’, Innovation Council, Skill Development Initiative Scheme (SDIS).

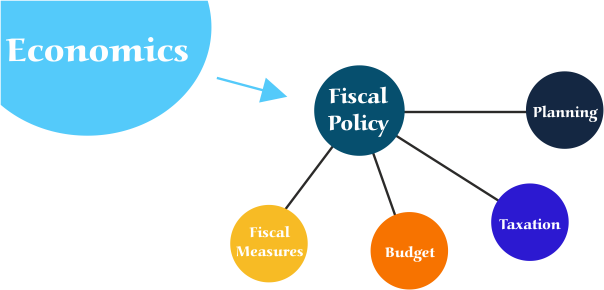

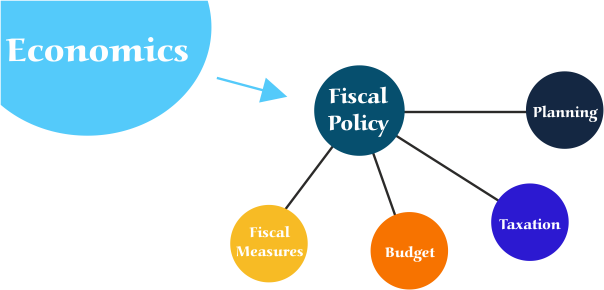

5. Fiscal Policy:

6. Market:

Focus:

- Money Market – Treasury Bills, Commercial paper, Certificate of Deposit, Call Money

- Capital Market – Government Securities (G-Secs)

- Difference between Money and Capital market

- A general idea about Stock-exchanges in India – BSE, NSE; Nifty (Abroad); what is SENSEX- what does it indicate?

- Regulatory Bodies – SEBI, IRDA , PFRDA – their power, functions in regulating Market, Mutual funds, Pension Fund etc.; reforms brought about by the Regulatory Bodies

- Foreign Direct Investment (FDI’s) and Foreign Institutional Investors (FII’s)

- On what basis are they classified as FDIs and FIIs?

- Differences between them

- Why are FII’s called ‘hot money’ or ‘Portfolio investment?

- Which type of investment would be better for India?

- Other investments such as Qualified Institutional Placement (QIPs) – Angel investors, Venture Capitals, Foreign institutional investors, Mutual Funds, Public Financial institutions

- Have a Basic understanding of these terms – Primary market, Secondary market, Bull and Bear (what does it symbolize), Derivatives, Futures, Bonds, Debentures – partially and fully convertible , Participatory Notes, Hedge Funds, Blue chip shares, Market depth.

- Mechanisms to raise money in the Capital Market in India by Foreign countries- Indian Depository Receipts (IDR’s); Similarly for an Indian company to raise money in the Foreign market – Global Depository Receipts (GDR’s) and in America it is known as American Depository Receipts (ADR’s)

7. Public Sector Units (PSU’s)

Focus:

- Organisational Structure of PSU’s – Departmental Undertakings, Statutory Corporations, Control Boards, Co-operative Societies, Companies registered under the Companies Act 1956

- Purpose/Objectives of PSU’s

- Reforms – post Liberalisation, Privatization, Globalisation (LPG) era- Disinvestment, Memorandum of Understanding (MOUs), Mini-ratnas, Navaratna, Maharatna, New Companies Act, 2013, Corporate Social Responsibility (CSR)

- What is Corporate Governance? What are its Objectives?

- Industry:

- Have a Basic understanding of these terms – Primary market, Secondary market, Bull and Bear (what does it symbolize), Derivatives, Futures, Bonds, Debentures – partially and fully convertible , Participatory Notes, Hedge Funds, Blue chip shares, Market depth.

- Mechanisms to raise money in the Capital Market in India by Foreign countries- Indian Depository Receipts (IDR’s); Similarly for an Indian company to raise money in the Foreign market – Global Depository Receipts (GDR’s) and in America it is known as American Depository Receipts (ADR’s)

- A general idea about Industrial Policies in India

- Medium and Small-Scale Enterprises (MSME’s ), Small-Scale Industries (SSI), Village and Cottage Industries (VCI)- On what basis are they classified so

- What measures are taken by Government to revive these industries?

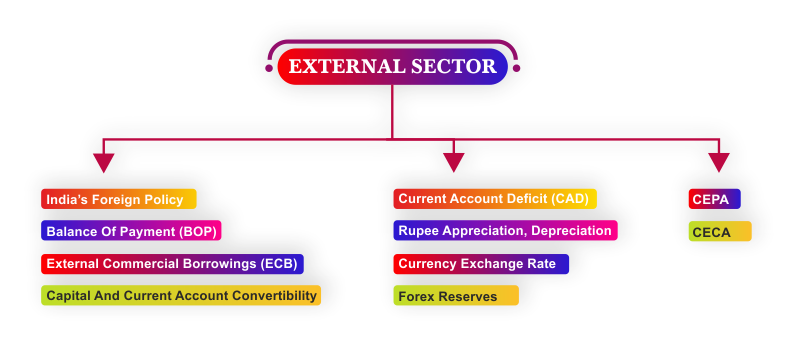

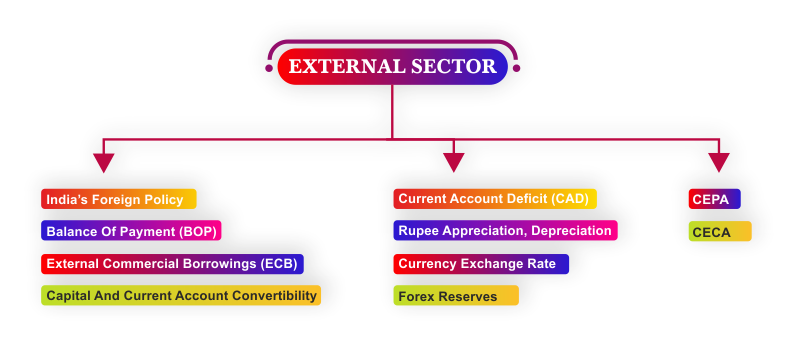

8. External Sector/Foreign Trade

Focus:

9. International Economic Organisations

Focus:

- Bretton Wood Twins- World Bank, IMF

- A general awareness on- When was it started? Where is its Headquarters?

- What is the purpose? To whom do they lend money to?

- How does it function?

- Reports published by WB and IMF

- Recently joined members of WB and IMF

- World bank and World bank Groups

- Relevance of IMF and WB to the developing countries (especially India)

- What are SDR’s ? How does it help member countries?

- World Trade Organisation (WTO)

- A general idea on how WTO came into being and what was the set-up before WTO

- Difference between General Agreement on tariffs and Trade (GATT) and WTO

- What is the objective of WTO? How does it function (example- WTO works on the principle ‘one country one vote’, unlike WB or IMF)

- Recently joined members of WTO

- Doha round – why is Doha round stalled? Issue’s between developed and developing countries

- WTO and India – how has it helped India, if so in what way? What are the issues- is it a boon or a bane to India?

- WTO principles – Most Favored Nation (MFN)- non-discriminatory Trade, General system of Preference (GSP) for developing countries and Preferential Trade Agreement (PTA), Free Trade Agreement (FTA) for economics integration

- Stages in economic integration – PTA > FTA > Customs Union > Monetary Union

- Others Safeguard mechanisms – Safeguard Mechanisms, Sanitary and Phytosanitary agreement (SPS), Technical Barriers to Trade (TBT)

- WTO agreements

1. Agreement on Agriculture(AoA) – Domestic support (Green Box, Amber Box, Blue Box), Export subsidies, Market access

2. Agreement on TRIPS and Patent Issues

- Make a note of the current issues related to Patent;

- Copyrights, Trademark, Industrial Design right – for what type of products are each given

- TRIPS agreement and Safeguards – Parallel importation, Compulsory Licensing

- Geographical indicators – significance; to what products and for whom are they granted to? A general awareness on the latest products which have been granted the status

3. General Agreement on Trade in Services (GATS)

- Difference between Protectionism and Import Substitution

- instruments of protectionism- tariffs, import quotas, administrative barriers, anti-dumping duties, direct or export subsidies, exchange rate manipulation

- A general idea about Anti-Counterfeiting Trade Agreement (ACTA) by World Intellectual Property Organisation (WIPO), Non-Agricultural Market Access (NAMA) group, NAMA 11.

- Regional trade agreements and Regional Groupings like ASEAN FTA, SAFTA, MERCOSUR, BRICS, SAARC, The Asia-Pacific Economic Cooperation (APEC), Trans-Pacific Partnership (TPP), G20 etc.

- their objectives

- recent summits especially where India is a major player in the grouping

- recent initiatives undertaken in the summits

- How do these initiatives help India?

Note: Make a note of the International Economic organisations to which India is not a member of; and on Asian Development Bank (ADB), G4.

10. Economic Survey

Focus:

Make note of the Key terms and their meaning, especially the new ones. Since UPSC has the knack of picking up specific terms from the Economic Survey in both Prelims and Mains Exam.

11. Social Development, Poverty and Inclusion:

This is a dynamic area as questions will be mostly related to recent developments and programs and policies of the government to address issues related to poverty, inclusion, growth and development. It has a wider perspective and also is linked with the current events.

12. Demographics:

This section overlaps with Human geography. Statistical data from Economic Survey will be helpful here like population, working age of the population, sex-ratio, literacy, Maternal Mortality Rate (MMR), Infant Mortality Rate (IMR) etc.

- What are the issues (Ex: low literacy ),

- Measures taken by the government in this regard.